If you run finance for a business, you already know this problem. Accounting is not where things go wrong. Things go wrong before accounting even begins.

Invoices come as PDFs. Receipts come as photos. Vendors send bills on WhatsApp. Someone downloads everything, sorts it, checks totals, fixes missing details, and only then does it become a clean entry in the accounting system. That messy “before” layer is what many people call pre-accounting.

What is pre-accounting?

So, what is pre-accounting exactly?

In simple terms, pre-accounting is the work that happens before transactions are posted into an accounting system. The pre-accounting meaning is straightforward: it’s the process of collecting documents and preparing clean, structured data so actual accounting becomes fast and accurate.

If you’re wondering what is pre-accounting in accounting process, think of it as the first stage of the finance workflow. It decides whether your books will be smooth or chaotic.

The pre-accounting process most businesses follow

A typical pre-accounting process looks like this:

Collect invoices, bills, receipts (PDFs, JPGs, emails, WhatsApp files)

Check key details (vendor name, date, tax fields, totals)

Fix missing or unclear information

Sort documents by type (purchase, expense, sales)

Decide how to code it (ledger, category, cost center)

Prepare it so that posting in the accounting software is easy

These are everyday pre-accounting activities. They don’t look “technical,” but they take time, and they decide the quality of your books.

Why does the pre-accounting workflow break in India

In India, the pre-accounting workflow often depends on informal systems:

WhatsApp groups for bills

Excel for cleanup

Phone calls for follow-ups

Manual entry in Tally/ERP

This is why people also describe it as accounting before bookkeeping. The bookkeeping team can’t move until the pre-work is done.

And when the workflow depends on people instead of a system, you get the usual symptoms:

wrong entries

duplicate bills

delayed posting

month-end panic

repeated corrections

The difference between pre-accounting and accounting

A common query is the difference between pre-accounting and accounting.

Here’s the clean distinction:

Pre-accounting = collecting, checking, cleaning, and preparing data

Accounting = recording transactions, classifying them properly, and generating reports

Pre-accounting is about input quality. Accounting is about final recording and reporting. If inputs are messy, accounting becomes slow and unreliable.

The role of pre-accounting in finance

The role of pre-accounting in finance is simple: it controls what enters your books.

Most finance problems don’t start in reports. They start with bad inputs:

incorrect tax fields

missing invoice numbers

mismatched totals

wrong ledgers

unclear narration

That’s why pre-accounting for businesses isn’t optional work. It’s foundational work. Better pre-accounting improves accuracy, reduces rework, and makes audits less stressful.

What is pre-accounting software?

Now, the next question: what is pre-accounting software?

Pre-accounting software is a tool that helps manage and automate the work that happens before posting entries into your accounting system. A pre-accounting tool typically focuses on turning documents into structured, usable data.

Depending on the product, it may also be called:

Pre-accounting automation software

accounting data preparation software

bookkeeping automation software

invoice processing software

expense management software

Different terms, same goal: reduce the manual workload before entries hit your books.

What good pre-accounting software should do

A useful pre-accounting software usually covers three things:

Capture

Invoices and bills from PDFs, images, email, WhatsApp uploads, and shared folders.Process

Extract key fields, validate totals, standardize formats, and reduce errors.Push

Export or post the structured output into your accounting system.

This is the biggest test. If the tool only captures documents but your team still spends hours cleaning data, it doesn’t solve the real pain.

Who needs it: small businesses and accounting teams

Pre-accounting software for small businesses helps when the owner or a small finance team is doing too much. It reduces time spent on typing, cleanup, and chasing missing details.

Pre-accounting software for accounting firms helps in a different way. It reduces back-and-forth with clients, standardizes documents, and makes it easier to handle volume without burning out the team.

Cloud and AI: what they should actually mean

Cloud-based pre-accounting software helps because teams can work from one place without version confusion and endless file forwarding.

And yes, you’ll see many tools marketed as AI-powered pre-accounting software. The right expectation is not “AI sounds fancy.” The expectation is: does it reduce manual checking, categorisation, and rework? If your team still types and fixes everything, it’s not doing the job.

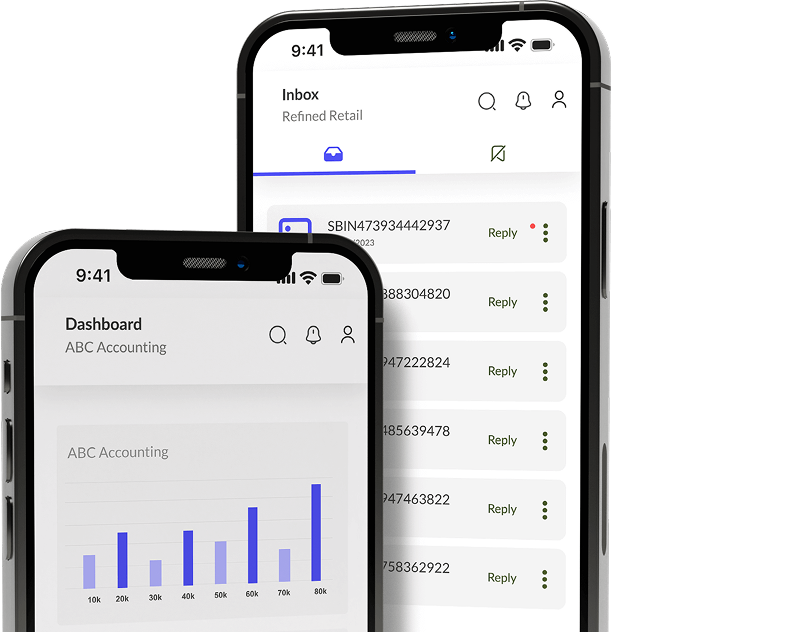

Where Accomation.io fits in this

If you relate to the “WhatsApp → Excel → Tally” cycle, you’re already dealing with pre-accounting in accounting every day. The real problem isn’t effort. It’s repetition.

This is where Accomation.io fits naturally as a solution. It follows a simple flow:

Pull data from PDFs, JPGs, Excel files, and more.

Process the data by cleaning and structuring it.

Push it into your accounting software.

So instead of bouncing between tools, you get one workflow that makes pre-accounting faster and cleaner, and makes your accounting team’s work easier.

If you want to see what that looks like for your use-case, click Book your free demo.